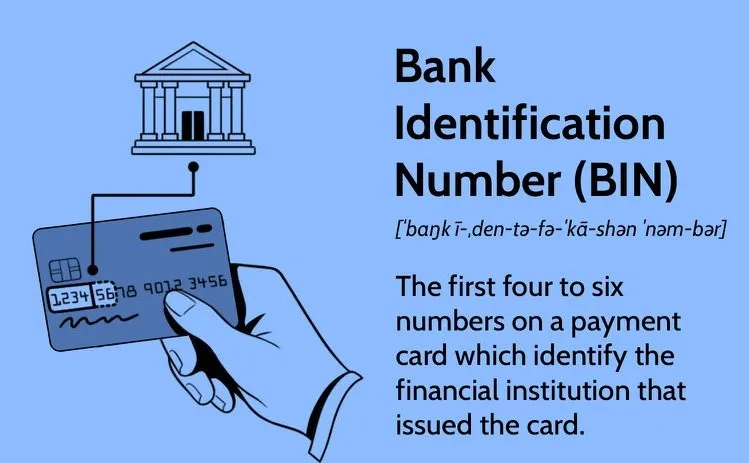

A Bank Identification Number (BIN) refers to the first four to six digits on a payment card. This sequence uniquely identifies the financial institution that issued the card and is essential in connecting transactions to the correct card issuer. BINs are used on various payment cards, such as credit, debit, and charge cards, ensuring that transactions are routed accurately.

Understanding Bank Identification Numbers (BINs)

The main role of a BIN is to assist financial institutions in identifying fraudulent activity, such as stolen cards, and help prevent identity theft.

ACCESS LEGIT VENDOR STORE!

How Bank Identification Numbers (BINs) Operate

BINs are part of a system established by the American National Standards Institute (ANSI) and the International Organization for Standardization (ISO). These entities created standards to identify institutions that issue payment cards. The ANSI is a nonprofit organization focused on developing business standards in the U.S., while the ISO provides global industry standards.

WATCH VIDEO HOW TO PURCHASE CC ⬇️

Each payment card is assigned a unique BIN, consisting of four to six digits. These numbers are imprinted on the front of the card and also appear below it. The first digit identifies the Major Industry Identifier (MII), while the remaining digits specify the bank or institution that issued the card. For example, Visa cards begin with a 4, identifying them as part of the banking and financial industry.

READ ALSO: How to buy a non vbv card/ CVV Online

When a customer makes an online purchase, they enter their card details. The first four to six digits are scanned, allowing the retailer to determine the issuing institution and other details such as:

- The card brand (e.g., Visa, MasterCard, American Express)

- The card level (e.g., platinum, corporate)

- The type of card

- The country of the issuing bank

Once the transaction is initiated, the issuing bank checks the card’s validity, account balance, and purchase eligibility. The system then approves or declines the charge. Without the BIN system, the payment processor would struggle to verify the source of funds, impeding the transaction.

Read Also: Carding Explained: A Complete Guide for Security Awareness

How to convert BIN to Credit card numbers

Credit card numbers are generated through a complex process that starts with the Bank Identification Number (BIN). The BIN is the first four to six digits of a credit card, identifying the issuing bank and card type. Online systems generate full credit card numbers by following specific rules based on the BIN structure. The next digits (known as the account number) are randomly assigned by the issuing bank to uniquely identify the cardholder’s account. Finally, the last digit is the checksum, calculated using the Luhn algorithm to ensure the validity of the number. This system helps prevent fraud and ensures proper routing of payments during transactions.

By understanding this process, merchants and customers can ensure secure and efficient transactions.

The Purpose of Bank Identification Numbers

BINs play a crucial role in facilitating smooth transactions and preventing fraud. They help merchants assess and authenticate card payments, ensuring a seamless purchasing experience. BINs also provide vital details, such as the issuing bank’s address and contact information, and verify whether the transaction is originating from the same country as the cardholder.

One of the primary functions of BINs is to safeguard against identity theft. By cross-referencing data such as the cardholder’s address and the issuing bank’s location, BINs can flag suspicious activity, such as potential fraud or data breaches.

ACCESS LEGIT VENDOR STORE!

Moreover, BINs streamline the payment process by allowing quick validation during card swipes, ensuring faster and secure checkouts.

How BINs Work: A Real-Life Example

To illustrate the functionality of BINs, consider a customer paying for fuel at a gas station. As the customer swipes their card, the payment system reads the BIN to identify the issuing bank. This initiates an authorization request that checks the customer’s funds. If the account is valid and funds are available, the transaction is approved; otherwise, it is declined.

What is a Bank Identification Code (BIC)?

A Bank Identification Code (BIC), or bank identifier code, is a special 8 to 11-digit code used for international transactions. The BIC is crucial when making cross-border payments. It can either be a connected BIC, part of the SWIFT network, or a non-connected one, primarily used for reference.

How Consumers Use BINs

While consumers don’t directly interact with BINs, understanding their significance can be beneficial. The first digit of the BIN indicates the major industry, and the remaining digits point to the issuing bank. Every time a transaction is made, the BIN helps validate the account and determine if the funds are sufficient.

Understanding BIN Scamming

BIN scamming is a type of fraud where criminals impersonate bank representatives to deceive victims. They may claim that the cardholder’s information is compromised and attempt to gain trust. Once the scammer has enough details, they may attempt to confirm the card number or solicit further sensitive information, like the full BIN.

The Importance of BIN Numbers

BINs play a critical role in modern payment systems. They not only facilitate the acceptance of diverse payment methods but also ensure the efficient and rapid processing of transactions. By providing key details about the card issuer, BINs help financial institutions detect stolen or compromised cards, thus protecting consumers and merchants from fraud.

Conclusion

In summary, The Bank Identification Number is essential to modern financial systems. These help identify the financial institution behind a payment card, facilitate secure transactions, and protect against identity theft. Therefore, it’s important to keep your BIN and other financial details secure. Always remember, your bank will never reach out to you via phone or email to notify you of a security breach. If you suspect a scam, disconnect immediately and contact your bank directly. Additionally, report the incident to the FTC for further assistance.

I couldn’t resist commenting